Giving generously at the office

But publishers fixated on the traditional source of sales are making a big mistake, because the only hope for the industry lies in generating at least 25% of sales by 2016 from sources other than the traditional print product.

Absent an unforeseeable upturn in the print ad business, a newspaper failing to generate 25% of its sales from non-traditional sources within 10 years will suffer something between flat to negative over-all revenue growth.

Because payroll, benefits, newsprint, fuel and other operating expenses surely will continue rising over the decade, a newspaper with flat to negative revenue growth will slide into contraction, unprofitability and eventual liquidation.

This conclusion flows from the following assumptions about the likely growth of newspaper revenues over the next decade:

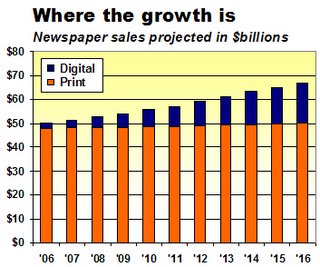

Based on average annual print sales growth of 0.5% since 2001, I am projecting yearly sales increases at this level from 2006 to 2016. While some may argue that this is too pessimistic, a growing number of analysts are haircutting their sales expectations for as far into the future as they dare to peer. Merrill Lynch now believes ad sales will be flat this year and down 1.5% in 2007 (vs. a previous forecast of a 1.1% gain). If ML is right, then my projections are way too rosy and newspapers will have to find more non-traditional revenues than I hypothesize.

On a brighter note for newspapers, digital sales have been growing at better than 30% for the last couple of years and are projected to keep gaining by that magnitude in the near future. But it is unrealistic to expect such robust growth to continue indefinitely. Accordingly, my projections assume a 32% growth rate in 2006 and then begin to scale down evenly each year to 11% in 2016.

The resulting projection (illustrated below) shows that a 25% revenue contribution from new media by 2016 could increase combined print and digital sales in the 10-year period by a compound annual growth rate (CAGR) of 2.8%. While this is not exactly torrid sales growth, the rate should be sufficient to achieve a modest but consistent increase in profitability for publishers, so long as expenses can be limited to something as close as possible to a 2% CAGR.

If you cut the digital contribution in 2016 to 12.5% of total revenues, then consolidated sales fall to a 1.5% CAGR. This growth rate likely would not be sufficient to cover rising expenses, regardless of how much newshole, health insurance and headcount were cut. No business can survive for long if expenses outpace sales.

The Newspaper Next task force working to come up with ideas to reinvigorate the industry urges publishers to formally set aside a significant percentage of their time to develop new on- and off-line products to serve the needs of their readers and advertisers – and, significantly, their NON-readers and NON-advertisers.

The managers at one of the papers participating in the project report that they now fruitfully focus 30% of their time on revenue-generating projects that do not involve the core paper.

With people focusing 95% of their attention on the main product and 30% on new ideas, it looks like it will take 125% worth of effort to restore the health of the industry.

Unfortunately for the stressed-out souls trying to save our newspapers, that sounds about right.

<< Home